Today's ICP, Tomorrow's Tesla?

特斯拉和InternetComputer都是市场颠覆式创新者,差别是特斯拉已经证明了电动车的无限潜力,而IC倡导的区块链云计算的理念还处在萌芽阶段,虽然看似两个完全不同的赛道,但按照财务数据的推演,我们运用了市销率和市盈率两种模型,能够对IC未来发展的一些可能性范本做出预测。感谢@kyle 之前的数据分析,为我的这个分析提供了线索。

Youtube: https://www.youtube.com/watch?v=dF9K5mSQrtU

Analysis Excel:https://docs.google.com/spreadsheets/d/1wRpwAQENHvAt6xsYOKG_z4uV_jY3znIk5DLoyS6AzE0/edit?usp=sharing

Twitter:https://twitter.com/MillionMiles

Both Tesla and InternetComputer are market disruptive innovators, the difference is that Tesla has proven the unlimited potential of electric vehicles, while the idea of blockchain cloud computing advocated by IC is still in its nascent stage. Although they seem to be two completely different tracks, according to the extrapolation of financial data, we have applied two models of P/S ratio and P/E ratio and are able to make some predictions on the future development of IC possible paradigms. Thanks to @kyle for previous data analysis that provided me with clues for this analysis.

First, I would like to start my analysis of Tesla's financial data over the years before I start talking about ICP's valuation. I would say that Tesla and ICP have some commonalities.

- They are targeting a large market, the current market size of $3-5 trillion in the automotive industry will be $1.5-1.6 trillion in 2030, almost ½ of the current automotive market, which is huge.

- They are both market disruptors, Tesla is the advocate of electric cars, ICP is the pioneer of blockchain cloud computing.

- Tesla was also extremely unrecognized in its early days, very small and on the verge of bankruptcy. ICP's current value in the blockchain circle is not recognized at all, probably because the concept is so far ahead of the curve, leading to the old forces of capital being scrupulous about ICP's maximalist vision.

Therefore I think Tesla has many characteristics that deserve to be used as important benchmark in this analysis of ours.

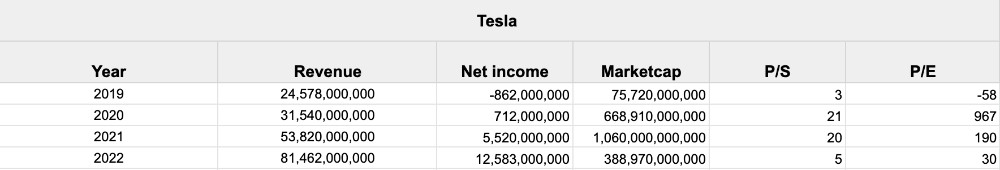

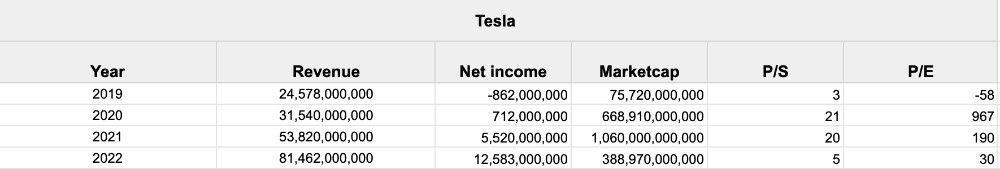

Below we will analyze Tesla's financial statements (revenue, net income, price-to-sales ratio P/S, price-to-earnings ratio P/E), from which we can understand how an innovative company can go from being unrecognized to being a capital market darling. (Source: https://companiesmarketcap.com/tesla/marketcap/)

- In 2019, Tesla is still in the vortex of losses, although revenue received $24.5 billion, but still a loss of $860 million, the market gave a PS and PE of 3 and -58 respectively.

- In 2020, after Tesla's revenue grows rapidly and gains a small profit, the market immediately gives an extremely high PS and PE valuation, and the PE even reaches a very high level of 967 near 1000.

- In 2021, Tesla's market capitalization exceeds $1 trillion after a surge in profits, with PS and PE still maintaining extremely high values.

In 2022, after Tesla's share price drops, although revenue and profits continue to increase, PS and PE also drop to a relatively reasonable level. With this financial data of Tesla we can clearly understand that

- Before there is no profit, the valuation according to the price-to-sales ratio is generally within 1-10, which is relatively reasonable, including a host of domestic car-making new forces are very serious losses, but the price-to-sales ratio is generally around 5-6

- Once Tesla is profitable in the new market, the market will give extremely high valuation multiples, we refer to the chart in 2020 data

- The PE of innovative companies on track is generally reasonable at 20-30x, refer to Tesla's value in 2022

So, before we start the ICP analysis, we will have an idea of the valuation of PS and PE at each stage of a company's development, and later I will use the two core valuation models, PS and PE, to analyze the future market value of ICP and the price of ICP.

This illustrates the characteristics of the valuation (P/S and P/E) that the capital market gives to companies at various stages of their development, especially once they have proven their competitiveness in a huge market, they will give a huge valuation premium in advance.

ICP Supply and Burn

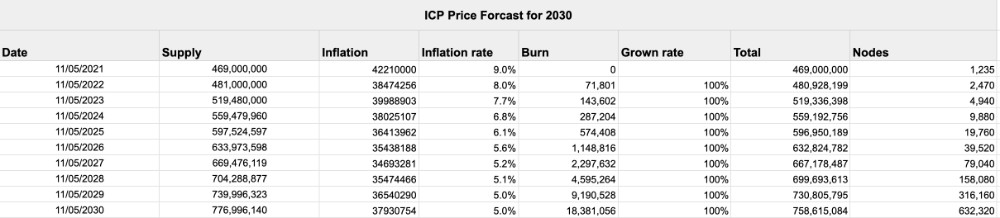

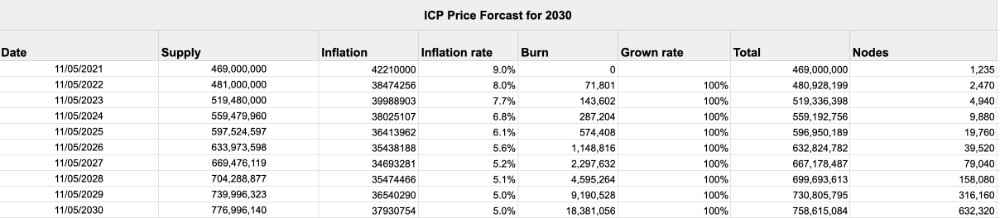

Next, I give you the data projection of ICP supply and destruction, because only by projecting the Token in 2030 number, we can estimate the market value and Token price later.

The initial total supply of ICP is 460 million Tokens, and the incremental rate decreases from about 9% per year to 5% per year in 2029, which means that by 2030, the total supply of the two is 770 million Tokens, which is the supply part.

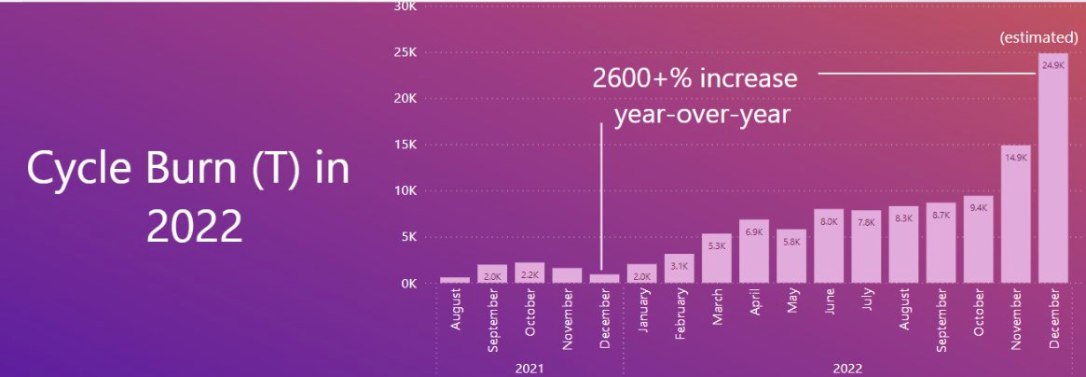

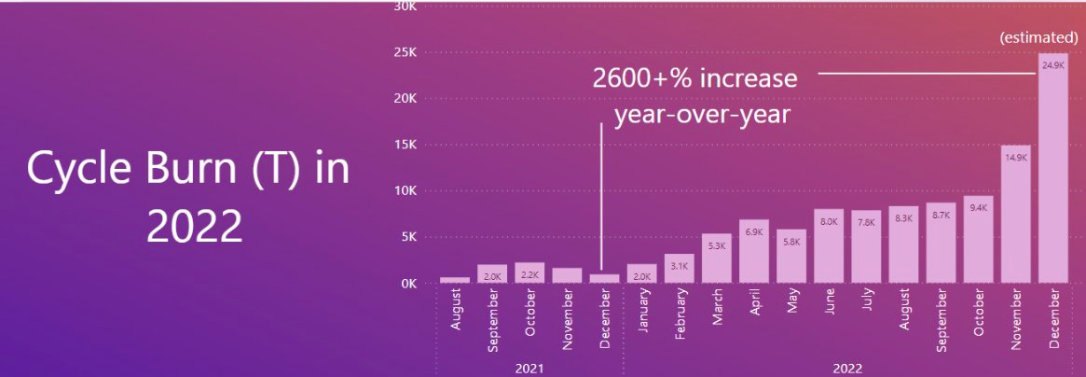

Then is the burn part, we first look at the bottom of this chart, showing the ICP 2022 Cycle combustion situation, compared to last year is 10 times or even dozens of times the growth, then we make an assumption, that is, combustion according to the compound annualized 100% growth, to 2030, the total supply minus combustion, should Total supply should be 750 million Tokens

The last column of Excel is the number of node machines, because the growth of combustion will certainly drive the increase of node machines, according to the current IC has 1235 node machines, also according to the compound annualized 100% growth, by 2030 there will be 630,000 node machines.

P/S value model derivation

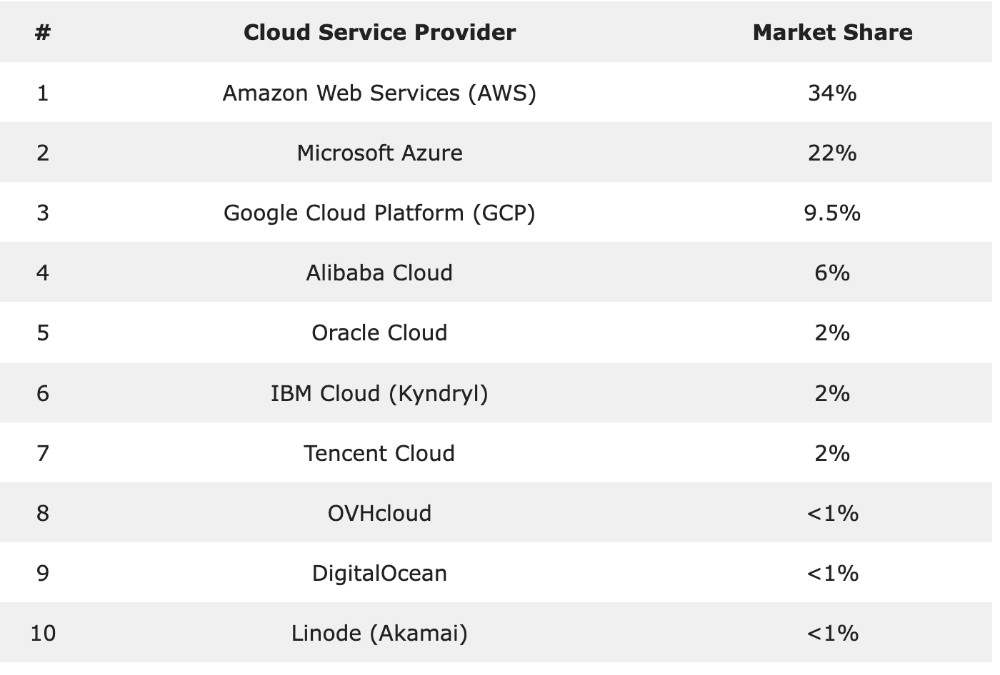

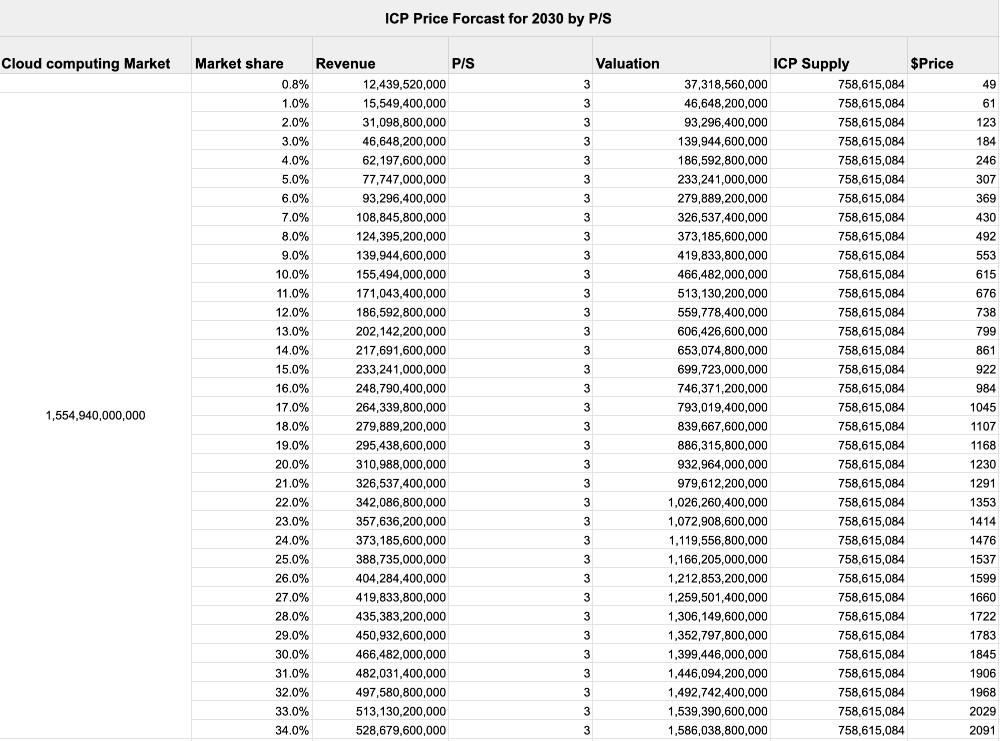

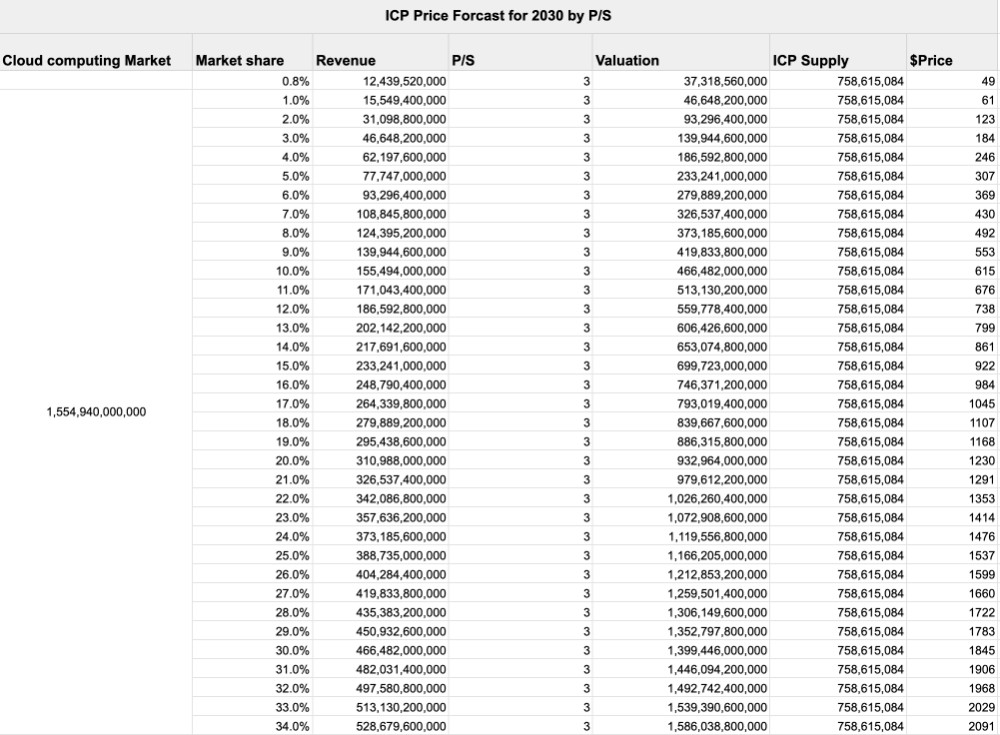

OK, so let's officially start our analysis of ICP's valuation. First of all, let's do an analysis of ICP's market capitalization and Token price in 2030 according to the price-to-sales ratio, or P/S. What I want to share with you is this chart.

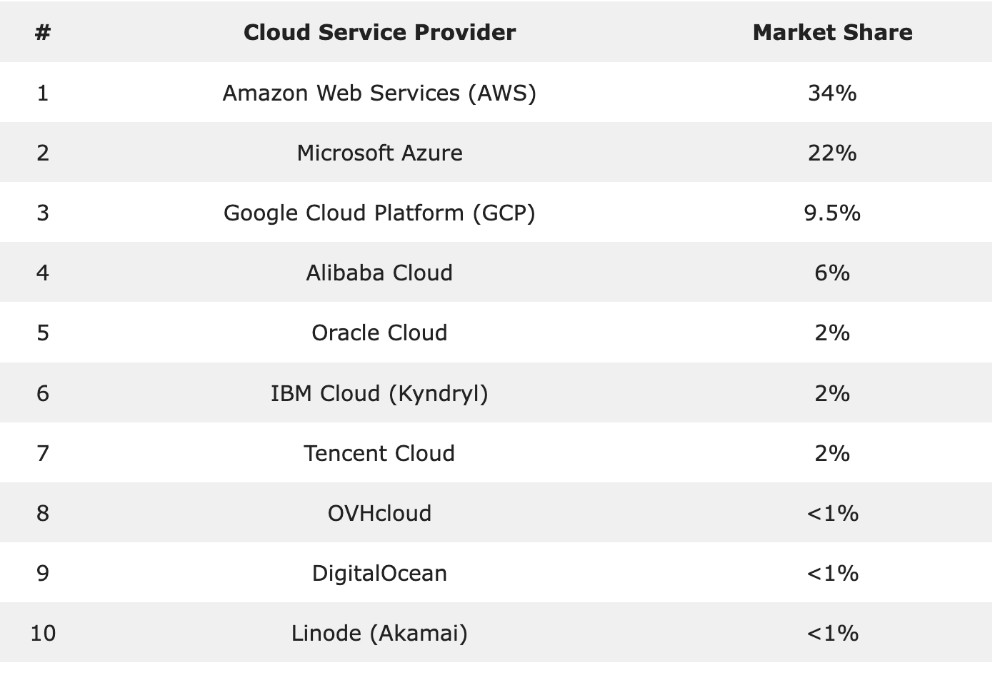

This chart shows the current cloud computing market, the market share of each company, and we can see that there are actually three classes:

- First, AWS and Microsoft, they basically maintain a market share of more than 20%.

- The second class, Google Cloud and Ali Cloud, is about 6-9% of the market share.

- The third class, such as Tencent Cloud, Linode, etc., is basically 1% to 2% of the market share.

Then we are clear about the current three classes of Benchmark, and several scenarios of possibilities that ICP will get if it can reach the corresponding market size in the future.

The market size of the cloud computing market in 2030 is roughly $1.5 trillion - $1.6 trillion (data source 1, data source 2)

By bringing in the corresponding market share, we can project the revenue of ICP, and according to 3 times P/S (same as Tesla 2019 P/S), we can get the corresponding valuation, and then according to the total supply of ICP calculated in the previous table, we can get the corresponding Token price projection)

- When ICP market share reaches 3rd gear (1%-2%), market cap is $46.6-932 billion and Token price is $61-123

- When ICP market share reaches the 2nd️ bracket (6%-9%), the market cap is $279.8-419.8 billion and the Token price is $369-553)

- When ICP market share reaches the 1st bracket (22%-34%) with a market cap of $1 trillion - $1.5 trillion, Token price is $1353-2091

Of course the P/S we bring in is very conservative at 3. Once we give a P/S of 7 or 8 times, the market cap and Token price will increase significantly. This is the value extrapolation according to the P/S model.

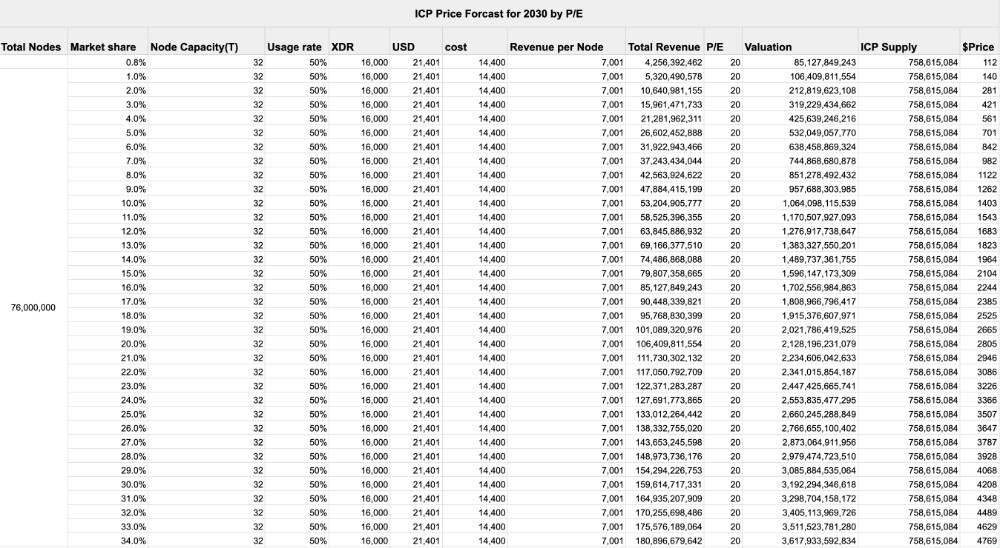

P/E model value derivation

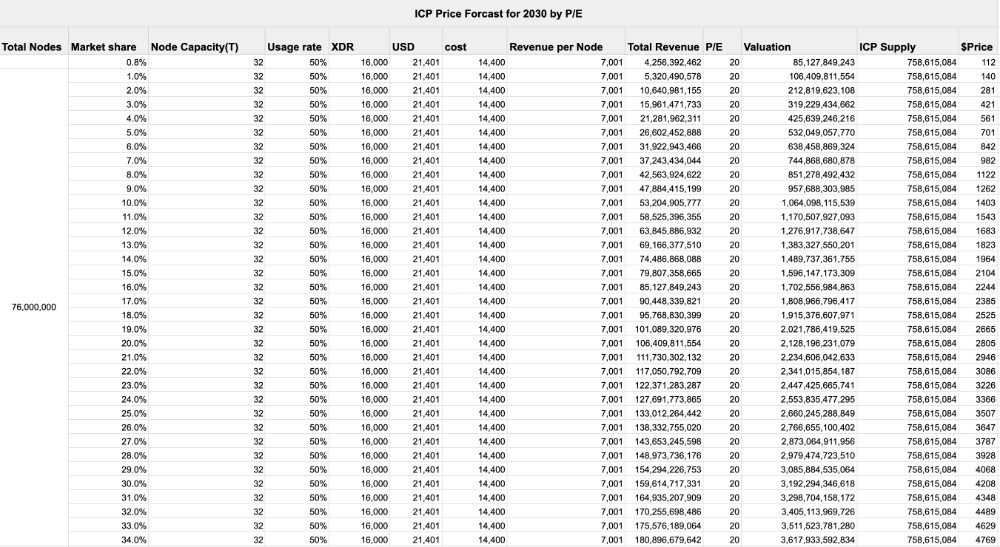

To obtain a valuation model projection of P/E, we must know the revenue and cost of IC for the next 2030, so we need to calculate the profitability and cost of nodes. The number of 76 million nodes on the far left of this table shows the estimated number of cloud computing nodes worldwide by 2030 (based on an overall market of $1.5 trillion). The current storage capacity of a node machine is 32Tb, and we assume a utilization rate of 50%, the revenue created by a node machine in a year is 16,000XDR (note: 1XDR = 1T case cycle), which is currently equivalent to 21401 USD, each node machine needs to pay the node operator about 14400 USD a year, that is, each node creates 7001 USD a year, and then according to the market share gained, we can estimate the total net profit (IC network does not need to pay the development and operation cost of Dfnity, so the node revenue is the net profit).

Summary

The data from the P/S and P/E valuation models can be used and we can draw an analogy with Tesla's data for 2020:

Tesla

- Tesla sales of 500,000 volumes in 2020, with 0.6% of global sales of 77.97 million volumes

- First profit at $700 million

- P/S of 21x

- P/E is 967x

ICP

- 630,000 ICP nodes in 2030, 0.8% of global node count of 76,000,000,0.2% higher market share than Tesla

- Earnings of $4.2 billion in 2030,Six times the profit of Tesla

- P/S if the same 21 times as Tesla, Token price will be $344.

- P/E if the same 967 times as Tesla, Token price will be $5426.

Finally, I would like to say that the change of technology will not be changed by the will of a certain part of the old power capital, it will be like a prairie fire that will completely change the existing technology landscape, no one can stop the advance of decentralized technology, I am glad that I can participate in this change, and ICP is bound to be the protagonist in this.

今日的ICP,明天的特斯拉?

深度解析“ 用市销率P/S模型和市盈率P/E模型对ICP进行估值”

特斯拉和InternetComputer都是市场颠覆式创新者,差别是特斯拉已经证明了电动车的无限潜力,而IC倡导的区块链云计算的理念还处在萌芽阶段,虽然看似两个完全不同的赛道,但按照财务数据的推演,我们运用了市销率和市盈率两种模型,能够对IC未来发展的一些可能性范本做出预测。感谢@kyle 之前的数据分析,为我的这个分析提供了线索。

首先,我想在开始分析一下历年特斯拉财务数据,为什么讲ICP的估值要先分析一下特斯拉呢。我想说特斯拉与ICP有很多共性:

- 他们目标瞄准的都是大市场,当前汽车行业3-5万亿美金的市场规模,2030年将是1.5-1.6万亿,差不多是当前汽车市场½,规模巨大。

- 他们都是市场的颠覆者,特斯拉是电动汽车的倡导者,ICP是区块链云的先锋

- 特斯拉早期也是极其不被认可,规模很小,濒临破产。 ICP目前在区块链圈的价值完全没有被认可,可能是因为概念太过领先了,导致旧势力的资本对于ICP的最大主义化的愿景都有所忌惮。

因此我认为特斯拉有很多特性都值得在我们这个分析中作为重要benchmark。

下面我们将具体分析特斯拉的财务报表(营收,净利润,市销率P/S, 市盈率P/E),从中我们可以了解一家创新型企业是如何从不被认可变成资本市场宠儿的。(数据来源https://companiesmarketcap.com/tesla/marketcap/)

- 2019年,特斯拉还处在亏损的漩涡中,虽然营收到了245亿美金,但是仍然亏损8.6亿美金,市场给的PS和PE分别是3和-58。

- 2020年,特斯拉营收快速增长,并获得小幅盈利后,市场立即给与了极其高的PS和PE估值,PE甚至达到了967接近1000的极高水平。

- 2021年,特斯拉利润暴涨后,市值超过了1万亿美金,PS和PE仍然维持极高的数值。

- 2022年,特斯拉股价下跌后,虽然营收和利润都继续增加的,但PS和PE也下降到了相对合理的水平。

通过特斯拉的这个财务数据我们可以清楚地知道:

- 在没有盈利之前,按照市销率估值一般在1-10以内,相对合理,包括国内一众造车新势力的亏损都很严重,但市销率一般都在5-6左右

- 特斯拉在新市场一旦获得盈利,市场将给与极其高额的估值倍数,大家参考图表中2020年的数据

- 走入正轨的创新性企业的PE一般在20-30倍合理,参考2022年特斯拉的数值

所以,在开始ICP分析之前,大家先对PS和PE的在企业发展的各个阶段的估值有个概念,后面我将使用PS和PE这两个核心估值模型对ICP的未来市值和ICP的价格进行分析。

这说明了资本市场在企业发展的各个阶段给与公司的估值(P/S和P/E)的特点,尤其是一旦企业在巨大市场里证明了自身的竞争力后,会提前给与巨大的估值溢价。接下来,我给大家介绍一下ICP供应和销毁的数据推算,因为只有推算出2030年的Token的数量,我们后面才能对市值和Token价格进行估算。

ICP初始总的供应量是4.6亿个Token,增发率从年9%左右,逐年下降,到2029年下降到5%,也就是到了2030年总供应两位7.7亿个Token,这是供应部分。

然后是燃烧部分,大家先看下底下这张图,显示了ICP 2022年Cycle燃烧的情况,相比去年是有10倍甚至几十倍的增长的,那么我们做一个假定,也就是燃烧按照复合年化100%进行增长,到2030年,共计供应减去燃烧,应该Total的供应应该是7.5亿个Token

Excel最后一列是节点机的数量,因为燃烧的增长,必然带动节点机的增加,按照当前IC有1235个节点机,同样按照复合年化100%增长,到了2030年将有63万台节点机。

P/S价值模型推演

OK,那我们正式开始对ICP的估值进行分析。首先我们按照市销率也就是P/S,对ICP 2030年的市值和Token价格做一个分析。我想给大家share的是这张图。

这张图的展示的是当前云计算市场的,各家公司的市场份额,那其实我们可以看到其实分为三档:

- 第一档,AWS以及微软,他们基本上都维持在20%以上的市场份额。

- 第二档,谷歌云和阿里云,大概在6-9的这个市场份额。

- 第三档,如腾讯云,Linode等,基本上就是1%到2%的市场份额。

那我们清楚了当前的三个档次Benchmark,如果ICP未来能达到相应的市场规模的话,会得到的几种设想可能性。

2030年云计算市场的市场规模,大概就是1.5万亿-1.6万美金(数据来源1,数据来源2)

通过带入相应的市场份额,我们可以推算出ICP的营收,按照3倍P/S(同特斯拉2019年P/S),可以获得相应的估值,再根据之前表格计算出的ICP总供应量,可以获得相应的Token价格推算)

- 当ICP市场份额达到第3档(1%-2%),市值为466-932亿美金,Token价格为61-123美金

- 当ICP市场份额达到第2️档(6%-9%),市值为2798-4198亿美金,Token价格为369-553美金)

- 当ICP市场份额达到第1档(22%-34%),市值1万亿-1.5万亿美金,Token价格为1353-2091美金

当然我们带入的P/S 为3是很保守的,一旦我们给到7或8倍的P/S,市值和Token价格都将大大增加。这就是按照P/S模型进行的价值推演。

P/E模型价值推演

要获得P/E的估值模型推算,我们必须知道未来2030年IC的收入和成本,因此我们需要计算节点的盈利能力和成本。这张表最左边7千6百万节点数展示了到2030年全球云计算节点数的估算(根据整体市场1.5万亿美金的数据),当前一个节点机的存储能力为32Tb,我们假定使用率为50%,一个节点机一年创造的收入就是16000XDR(注:1XDR=1T 案cycle),当前相当于21401美金,每一台节点机一年需要支付给节点运营商的费用大概是14400美金,也就是每个节点每年创造7001美金的收入,再根据所获得市场份额,我们可以估算出总的净利润(IC网络无需支付Dfnity的开发运营成本,因此节点收入即为净利润)。最后我们根据一般创新性企业的合理P/E估值倍数(20-30),可以估算出IC的估值,再根据ICP的供应可以获得ICP的价格。

总结

可以通过P/S和P/E估值模型的数据,我们可以将它与特斯拉2020年的数据做一个类比:

特斯拉

- 2020年特斯拉销量50万量,销量占全球销量7797万量的0.6%

- 首次盈利,达到7亿美金

- P/S为21倍

- P/E为967倍

ICP

- 2030年ICP节点数63万个,占比全球节点数76000000的0.8%,比特斯拉市场占有率高0.2%

- 2030年盈利42亿美金,是特斯拉利润的6倍

- P/S如果与特斯拉相同的21倍,Token价格将是344美金。

- P/E如果与特斯拉相同的967倍,Token价格将是5426美金。

最后,我想说,技术的变革不会以某一部分旧势力资本的意志而改变,它会像燎原之火一样彻底改变现有的技术格局,没有人能阻止去中心化技术的前进,我很庆幸我能够参与到这场变革之中,而ICP必然是这其中的主角。