火币研究院:DePIN 赛道现状及发展预测,入局 DePIN 中长期潜在获利预期超 400 倍

本报告探索了迅速发展的DePIN领域,特别是在Solana网络中,该网络以其坚实的基础设施和创新应用而闻名。DePIN项目优先考虑实际盈利性而非投机性财务,并在整合隐私增强、零知识证明和人工智能等技术方面发挥了关键作用。DePIN与其他生态系统的战略可组合性,定位于通过数据完整性和可扩展解决方案,转变经济系统。 作为DePIN的领先平台,Solana体现了高性能区块链技术与物理网络的整合,承诺带来显著的经济回报,并开创将技术与实际应用融合的新方式。

引言:DePIN——当前状态与展望

去中心化物理基础设施网络(DePIN)正通过其对现有基础设施的创新利用和以数据为中心的商业模式,重塑区块链领域。DePIN超越传统物联网框架,以其去中心化的效率和成本效益而脱颖而出。

本报告探索了迅速发展的DePIN领域,特别是在Solana网络中,该网络以其坚实的基础设施和创新应用而闻名。DePIN项目优先考虑实际盈利性而非投机性财务,并在整合隐私增强、零知识证明和人工智能等技术方面发挥了关键作用。DePIN与其他生态系统的战略可组合性,定位于通过数据完整性和可扩展解决方案,转变经济系统。

作为DePIN的领先平台,Solana体现了高性能区块链技术与物理网络的整合,承诺带来显著的经济回报,并开创将技术与实际应用融合的新方式。

这篇文章撰写于HTX Ventures 旗下的研究院团队。HTX Ventures是火币HTX的全球投资部门,整合投资、孵化和研究以识别全球最优秀和最有前景的团队。目前,HTX Ventures已支持跨越多个区块链赛道的200多个项目,其中部分优质项目已上线火币HTX交易。

结论

- DePIN 虽然叫 去中心化物理基础设施网络,但核心的业务增长逻辑并不是硬件本身,而是如何对数据进行更有效的利用,无论是数据存储,还是数据传输,数据共享,或者数据使用。

- DePIN 没必要去对标传统的 IOT,思考的时候也不必需划分 Web2 抑或是 Web3,只要是能够更高高效的利用数据,更有效的做好经济上的分配,就是好的东西。

- DePIN 的发展将结合区块链以解决数据可信性问题,同时将会沿着物联网展开大规模协议,创作人和人、人和机器,以及机器和机器之间的无限之网。

- 考察DePIN 项目的时候,更应该抛弃投机或者金融属性,这些更适用于defi,meme,Brc20等这些。考察DePIN 应该关注项目本身真实的盈利能力。

- DePIN 赛道短期值得去关注的是与其他生态的可组合性,包括 DePIN x Privacy,DePIN x Gaming,DePIN x ZK,DePIN x AI, 长期来看,Depin 未来的畅想蓝图,包含了 零工经济(gig economy), 共享经济,数据可信。

- Solana网络已经成为DePIN项目部署的首选区块链, Solana DePIN 代表了超过100 亿美元的FDV 和40 亿美元的市值。

- Solana 在DePIN发展的优势有

- 性能优势叠加技术升级

- 强大的Token 标准和生态系统

- 费用优势

- 流动性集中,生态可组合性强,社区统一

- 开发者社区活跃,创新项目和新概念层出不穷

DePIN 是什么

Messari 在2023年初发布的研究报告《The DePIN Sector Map》中正式提出了 DePIN(Decentralized Physical Infrastructure Networks,即去中心化物理基础设施网络)概念,将其定义为「利用加密经济协议部署现实世界的物理基础设施和硬件网络」。简而言之,DePIN 通过基于区块链的代币激励,促使各方参与者共同建设物理基础设施网络。

除去名词的演进,「利用加密经济协议部署现实世界的物理基础设施和硬件网络」的项目实际上已经存在很长时间。例如,去中心化网络Helium成立于2013年,去中心化存储Storj成立于2014年,这些团队早在通信、存储等领域就自发地探索如何以去中心化方式建设物理基础设施网络。随后,互联网、人工智能、能源、数据收集等领域也逐渐加入,尽管细分领域各有差异,但核心逻辑是一致的,最终形成了今天繁荣的 DePIN 赛道。

DePIN赛道整体现状

DePIN 板块梳理

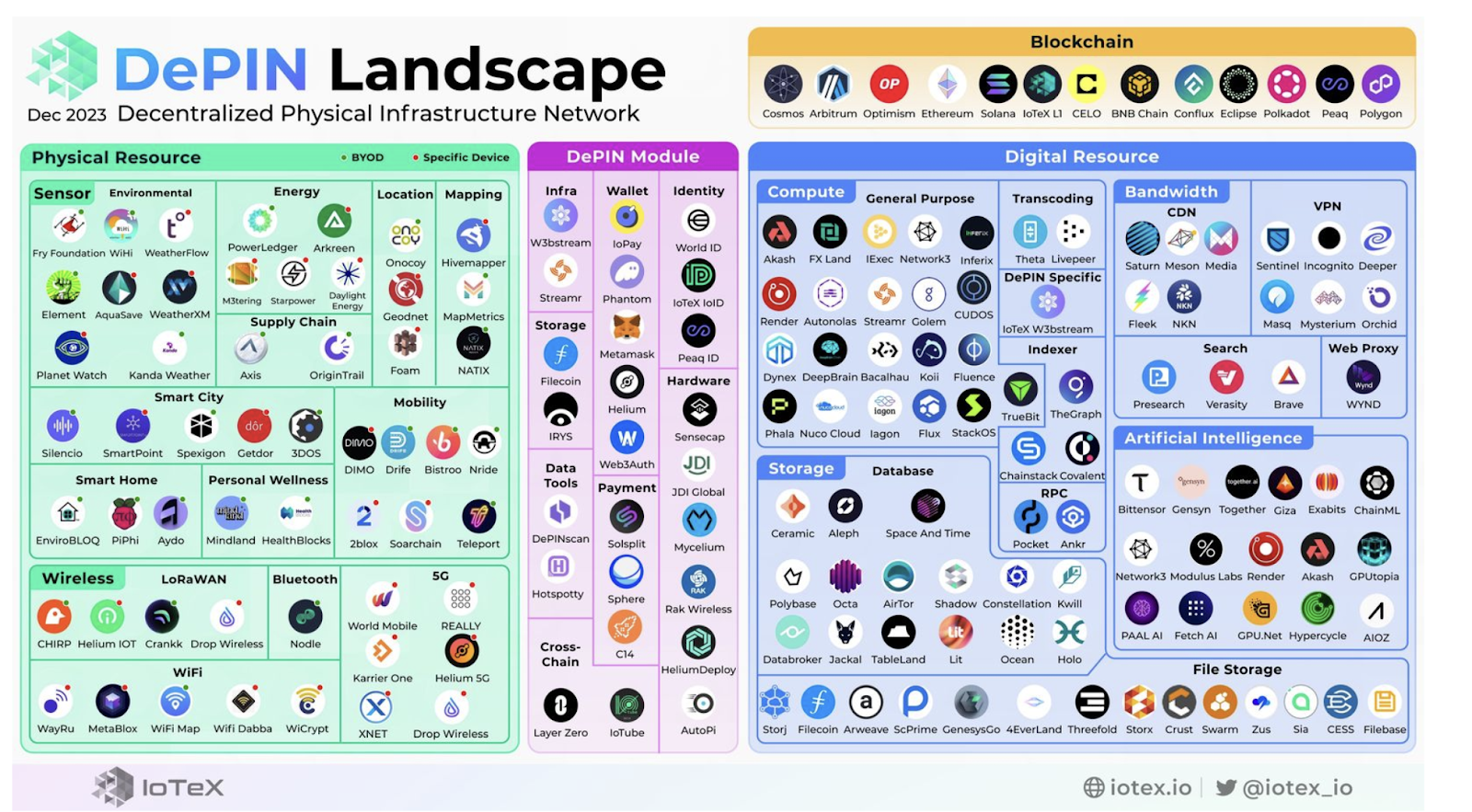

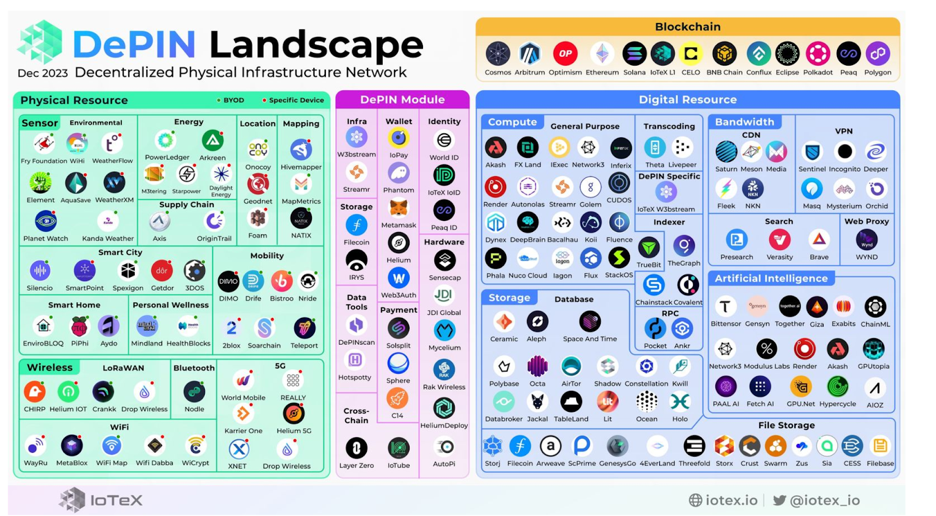

根据Messari 和 Depin.Ninjia数据,2023 年DePIN 生态系统已发展到超过650 个项目,市值 $35B ,涵盖了六个子产业:计算(250 个)、人工智慧(200 个)、无线(100 个)、感测器(50 个)、能源(50 个)和服务(25 个)。Messari对于 DePIN 板块的总潜在市场规模做了预测大约在 2.2 万亿美元左右,到 2028 年可能达到 3.5 万亿美元。

据CMC数据,已经发币的DePIN 项目共有60个已发币项目,市值为13.3亿美金。目前市值排名前100的DePIN项目有FIL,RNDR,HNT,THETA,BTT,AKT和AR。其他赛道里较头部的项目有IOTX,ANKR,和AI相关如TAO等。从 DePIN 领域目前市值排名前 10 的项目来看,大部分都属于 AI 、Storage 和 Computing 领域。DePIN目前占整个Crypto 市场的的份额,都是非常小的,低于Meme,Defi,NFT 等板块。 若对比传统物联网行业市值上亿项目21个,上10亿项目仅有4个。

如果按照这一数据进行推论,那么在中短期,入局 DePIN 的潜在获利预期在 243 倍左右,而中长期获利预期则超过 400 倍。

Depin项目板块拆解

这里参考的是 IOTEX 的板块拆解方式, 整体分为软件-硬件两部分。

硬件部分有,传感器和无线网络两大板块,软件部分有计、存储、网络分发、人工智能四个板块。

DePIN 项目虽然叫 - 去中心化物理基础设施网络,但所有的核心业务逻辑都是围绕如何从数据中获取价值展开的。

- 传感器--负责数据收集

- 无线网络及网络分发--负责数据传输

- 计算板块--负责数据的计算

- 存储板块--负责数据的存储

- 人工智能--负责数据应用,

所以,DePIN 项目本身是从硬件开始,但是真正的发展在于如何应用好数据,这和传统互联网经济的发展模式是如出一则的。

在评估一个Depin 项目的前景的时候,要从数据的角度去进行思考,谁用好了数据,谁掌握了数据,谁就是好项目。

要抛开Crypto 中投机的部分,回归务实价值的部分。

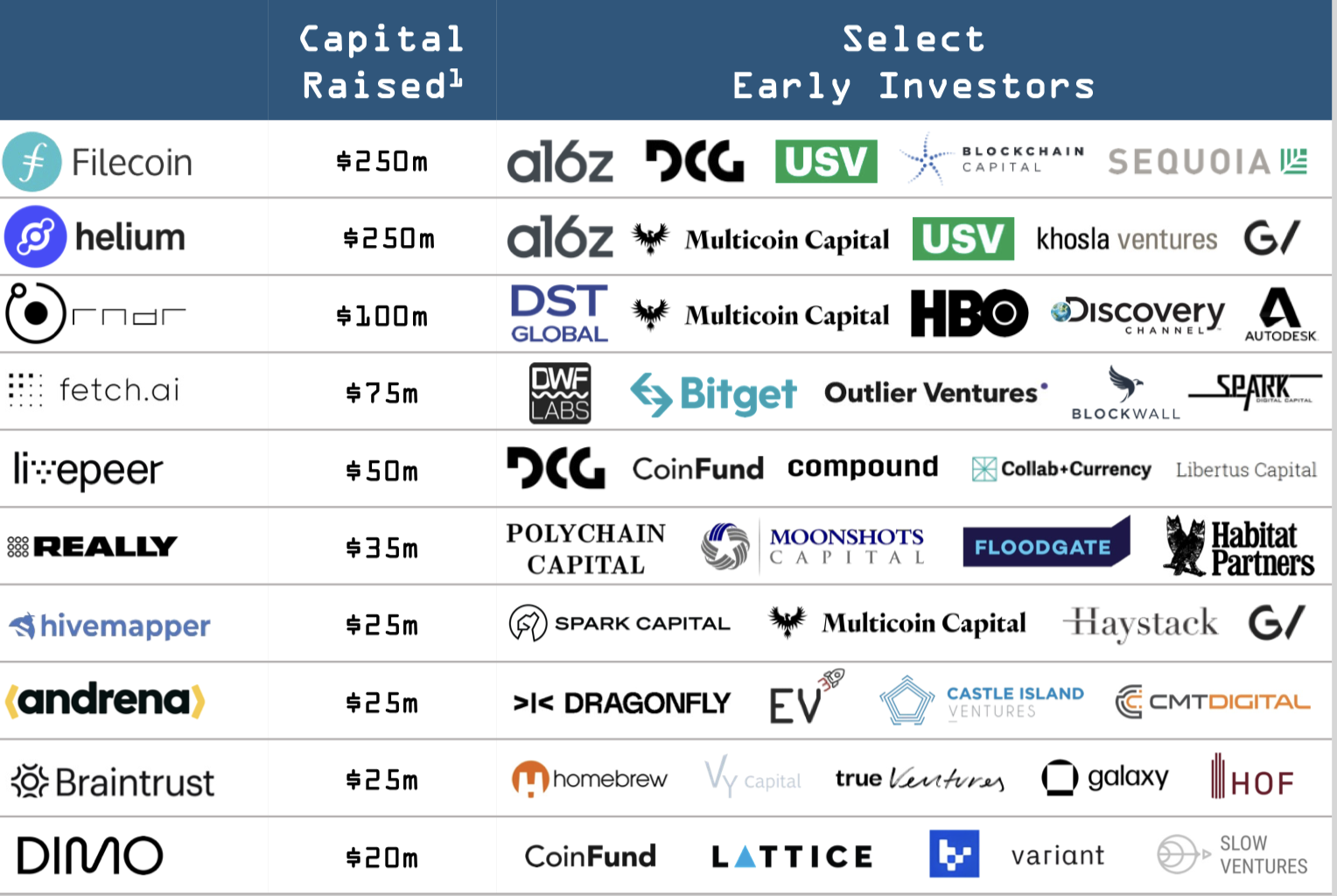

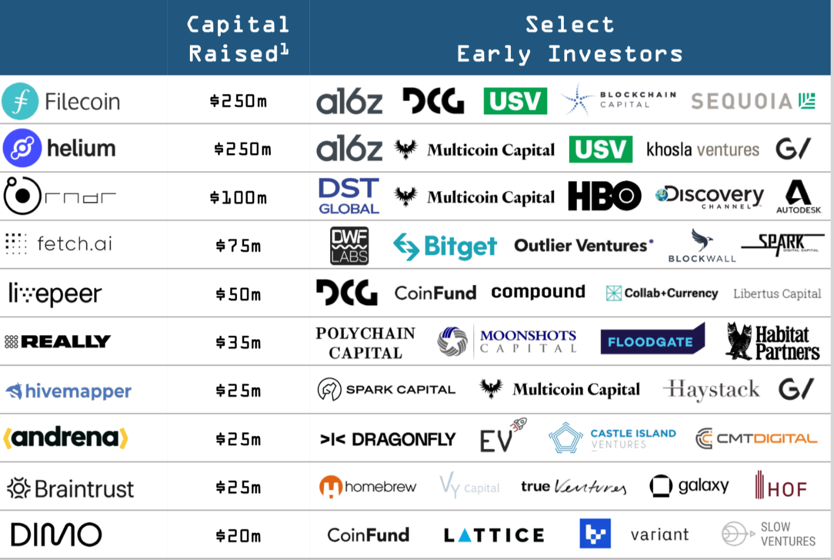

DePIN 的投资者

正如刚才所提到的,DePIN 赛道其实一直都有投资机构以及创业者在布局,只是 2023 年初的市场环境不适合,并且关于 DePIN 的新范式还在探索之中,因此很少推出新的 DePIN 项目。到了 2023 年底,无论是市场环境的向好还是创业者的探索积累,许多项目从最初的理念逐渐落地初具雏形,于是开始陆续推出市场,之后的动作才被市场捕捉到,此时DePIN在技术创新乏力的市场中迅速占据了重要的位置。

例如, Multicoin, Borderless, A16Z, HTX Ventures 等VC 都在 DePIN 有较多布局,并且投出的项目都是应用性非常强的,投机属性非常弱的项目,当然,相对于他们自己本身的Portfolio来看,DePIN的项目也只占比较小的部分。

机构

项目数量

项目

1

Borderless

13

hivemapper,Xnet, Render, Helium, Arweave, filecoin, Dimo, Dabba, Planetwatch, CUDO, WAYRU, CLIMATE TRADE, Daylight

2

Multicoin

12

Fluence, BrainTrust, Dabba, Arweave, dClimate, Blackbird, worldcoin, livepeer, Render, helium, Io.net, hivemapper

3

Coinfund

9

Numeraire, upshot, Giza, worldcoin, dClimate, GIANT, Livepeer, Dimo,Gensyn

4

A16Z

6

Arweave, Blackbird, worldcoin, filecoin, Helium,Braintrust

5

DCG

6

Bittensor, Livepeer,Fleek, FIlecoin, worldcoin, Meson Network

6

Polychain Capital

5

Filecoin, Fleek, Really, upshot, Bittensor

7

Varient

4

Blackbird, Braintrust, Dimo, Worldcoin

8

PlaceHolder

5

Foam, Filecoin, weatherXM, Numeraire, Arweave

9

Lattice

4

Arweave, Dimo, Filecoin, Nosh Delivery,

10

HTX Ventures

4

CESS, EverPay, Pyth, Spacemesh

下图补充一下头部DePIN项目的融资情况,

Top DePINs by Capital Raised

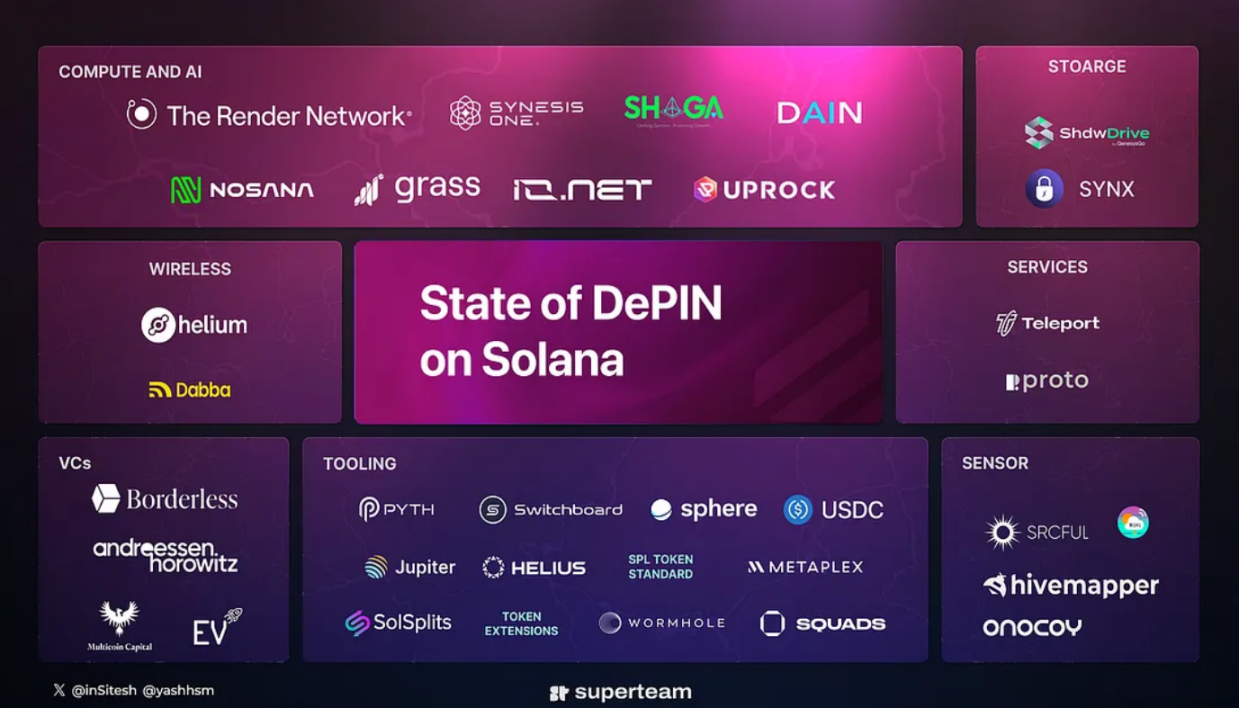

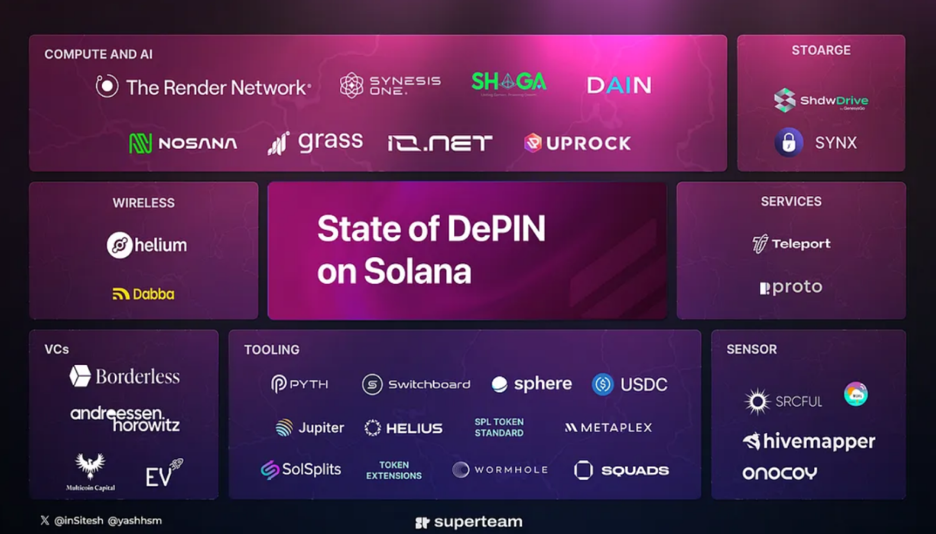

Solana DePIN生态调研

Solana网络已经成为DePIN项目部署的首选区块链

- Solana DePIN 代表了超过100 亿美元的FDV 和40 亿美元的市值。

据CMC,目前市值排名前500的Solana DePIN 项目有Render Network(RNDR)、Helium Network(HNT)、Helium Mobile(MOBILE);其余DePIN 有Helium IOT(IOT)、Hivemapper(HONEY)等。近期这赛道较高热度的项目有Solana相关的HNT系列如MOBILE和IOT,加上可能即将发币的getgrass,带宽网络市场项目。

- DePIN赛道与Solana网络是互相选择的结果。

对 Mass Adaption 的不可替代性,尤其是 DePIN 和 Web2 应用。Solana 成功撑住了 STEPN 的需求,这也是 Web3 真正出圈了一把的项目。

Solana 的 cNFT 为 DePIN / PoPW 的节点提供更具成本效益的授权证书,这是一种常见做法。

RNDR和Helium项目的迁移,赋予了项目本身更强的能力。比如这一转变为Render带来了包括实时流媒体、动态NFT及状态压缩等新能力,显著提高了网络的性能和可扩展性,同时为用户开启了更加丰富和多元的应用场景。

DePIN 这类项目,不同于高价值的 DeFi 应用,更接近于传统的边缘计算等 IoT(物联网)概念,更看重稳定和低价,Solana 天然在同步速度上具备优势,以目前最火的 Helium 为例,IoT 数量达 30 万以上,5G 设备也有 3000 以上,大量硬件的调配只有 Solana 能满足。

- DePIN 为Solana 生态系统带来高价值

像Helium 这样的项目显著增加了活跃的钱包数量。仅Helium 每月报告超过6 万个活跃钱包参与活动,例如领取奖励、质押、委托或销毁Token,而其他超过3 万个钱包使用其他SPL 程序,突显了Helium 对Solana 生态系统的影响。

从监管的角度来看,DePIN 展示了Solana 在监管机构和政策制定者眼中的实际应用,增强了其合法性和品牌认知。

Solana网络优势更为明显

- 性能优势叠加技术升级

包括高吞吐量,官方宣称Solana 每秒约可处理 65,000 多笔交易,日常运行也有 2500-3000。其他性能包括,快速交易确认、可扩展性、区块大小。在未来的 Firedancer 升级后,理论 TPS 能到 100 万+,日常 TPS 估计也能到 10 万+,这也是 Visa、DePIN 选择 Solana 的最主要因素。

- 强大的Token 标准和生态系统

一个充满活力的生态系统,具有经过充分测试的DEX 和建立的标准,例如cNFTs(压缩NFTs)、pNFTs(可编程NFTs)、Token Extensions 等,为DePIN 项目提供了开发和推出他们的链上产品的基本组件。

- 费用优势

即使是坎昆升级之后,Solana仍然是gas费较低的Layer1。头部 L2 中,DA 层已经切换为以太坊主网 Blob 的,有 ZK Rollup 系的 ZkSync 和 Starknet,Optimistic Rollup 系的 Optimism、Base。四家 L2 的 Gas 费下降 1 个数量级,但并没有切换到Celestia,费用并没有降到最低。

- 流动性集中,生态可组合性强,社区统一

以太坊及其Layer2之间意识形态化严重,互相争夺流动性。这在这轮小牛市表现尤其突出,技术和生态上区分不大,造富效应不显著。通用L2完全不是 Solana 等竞争链的对手。

在近期meme币的强势推动下Solana defi生态也出现爆发,TVL也达到33亿美元。这也意味着Solana上会有更强的收益产品及投机产品,再叠加RWA、AI、DePIN 项目,defi产品的可组合性将更强。

- 开发者社区活跃,创新项目和新概念层出不穷

通过黑客马拉松和各种激励措施,Solana 培养了一个活跃的开发者社区,这为其生态系统的发展提供了动力。后续出现了 Magic Eden,Stepn,jito 等 Top 项目。即使在熊市期间,Solana 依然保持着开发者生态和社区活动,通过持续激励措施和黑客马拉松,Solana 持续完善基建并激发更多创新应用的开发,进一步推动生态系统的繁荣,

- 造富效应是最好的营销手段

Saga的巨额空投引领加密手机新玩法,带动Solana生态社区的统一,包括 Solend、Helius、Chads 和 Solcial,已经宣布为 Saga 2 的所有者提供空投、福利和赠品。近期牛市中的meme币,$BOME也实现了3天上币安的奇迹。

生态发展情况

Solana DePIN 项目梳理如下表所示:

Depin分类

项目名称

无线网络

Helium、WIFI Dabba

存储网络

Shdw Drive、Aleph

传感器

Hivemapper、Onocoy、WiHi

AI

Render、Io.net、Nosana、Grass、Synesis One、UpRock、Shaga、DAIN

服务

Teleport、Proto

基础设施

Sphere、Solsplits、Token标准(压缩型NFT、SPL token)

Solana DePIN 生态小结:

龙头项目:RNDR、Helium

- RNDR,一个去中心化的渲染平台。

- Helium Network,无线网络项目。自2014年开始发展,累计完成金额超$350M的融资,投资方包括a16z、德国电信、Google、Tiger Global等圈内外知名基金。Helium在今年4月迁移至 Solana 区块链。HNT目前CMC排名64。

第二阶梯项目:Helium系列(MOBILE和IOT)、io.net、Nosana

- MOBILE和IOT是属于Helium生态系统内项目,

- IOT:这是 Helium IoT 网络的协议代币,由 LoRaWAN Hotspots 通过数据传输收益和覆盖证明进行挖掘。

- MOBILE:这是 Helium 5G 网络的协议代币,奖励给提供 5G 无线覆盖和 Helium 网络验证的人。MOBILE目前CMC排名166。

- io.net,透过整合来自资料中心、加密矿工和像Render 这样的已建立专案的GPU 网络,来利用运算力进行机器学习应用,定位自己为“GPU 聚合器”。尚未发币,目前推特粉丝426k。A轮融资总额达到3000万美元,Hack VC 领投,Multicoin Capital、6th Man Ventures、M13、Delphi Digital、Solana Labs、Aptos Labs等参投。目前GUP矿工数量已达5万以上。

- Nosana,一个连接用户提供的GPU 网路和旨在开发人工智慧产品的消费者的市场。

潜力项目:ALEPH、HONEY、Shadow

- ALEPH,存储解决方案,跨链数据库。

- Hivemapper (HONEY) 于 2022 年 11 月推出,是一个去中心化的全球地图网络,奖励通过 Drive-to-Earn 模型使用行车记录仪收集大量 4K 街道图像的贡献者。22年4月,完成 1800 万美元融资,Multicoin Capital 领投,Solana 创始人、Apple Maps 前高管和 Helium 首席执行官等行业人士参投。目前CMC排名513。

- Shadow,作为Filecoin 的竞争对手,Shdw Drive 利用高效能的传统和行动运算,降低了企业级资料中心储存的成本 – 将此技术称为“DAGGER”。

DePIN未来发展预测

- DePIN赛道对基础设施要求高,需要满足高吞吐量要求,所以DePIN项目将会选择在性能较高的Layer1上建立,甚至会选择在Layer2或Layer3上。

- 更多项目可能性,例如清洁能源基础设施和虚拟电厂:项目Daylight 和Etheos

- DePIN项目向大平台化转型,例如Helium和Render,以便更小DePIN项目可以利用它们进行开发

- DePIN专用链,我们已经看到了两个专门针对DePIN 的EVM/substrate 链,例如Peaq 和IoTex。此外,一些蓝筹DePIN 专案之一,Dimo,也正在使用Polygon CDK 建立他们的链,显示了对应用链的需求。

- DePIN与其他生态赛道的可组合性。这在Solana上尤为明显,比如Bonk的空投对Saga的造富效应。未来会有更多Depin与defi的结合,增加收益和投机,Depin与RWA的结合,为项目的融资提供解决方案、或现实世界提供数据等。

具体举例来说,

- DePIN x ZK,

随着技术不断发展,像ZK TLS 这类技术能够有效的证明 Web2 或者 Web3 数据的真实性,打通Web2数据到Web3的通路,DePIN 结合 ZK 技术,将催生出一大波能够对Web2 项目进行吸血鬼攻击的Web3项目,要对此保持关注。

例如 Space and Time 这个项目,

Space and Time 是可验证的计算层,可在去中心化数据仓库上扩展零知识证明,为智能合约、LLM 和企业提供无需信任的数据处理。Space and Time 将来自链的索引化区块链数据与链下数据集连接起来,并且采用了 Proof of SQL 可确保大规模计算的防篡改,并证明查询结果未被操纵。

Proof of SQL 是 Space and Time 开发的新 ZK-proof,允许数据仓库生成 SQL 查询执行的 SNARK 密码学证明,证明查询计算是准确完成的,并且查询和数据都是可验证的篡改。

开发人员可以通过项目来连接索引化的链上数据和链下数据,使用 SQL 转换数据执行低延迟缓存查询和大型分析作业,将数据转换和塑造为特定于您的业务的模式,将查询发布到 API 和构建 dashboard, 同时零知识技术可以保证以去信任的方式将防篡改的查询结果发送到智能合约或者直接在链上发布。

目前 Space and Time 已经为以太坊、 Polygon 、 Sui 、 Sei 和 Avalanche 建立了索引,并且正在不断支持更多链,同时已经接入了 Chainlink 。

- DePIN x AI,

去中心化物理基础设施网络的发展可能会从根本上改变数据的使用方式,如去中心化机器学习,Bittensor 就是一个例子。

Bittensor 是一个开源协议,为去中心化、基于区块链的机器学习网络提供支持。机器学习模型在 TAO 中进行协作训练,并根据它们为集体提供的信息价值获得奖励。TAO 还允许外部访问,允许用户从网络中提取信息,同时根据自己的需要调整网络活动。

- DePIN x Privacy,

在前面也一直强调,DePIN 虽然是去中心化物理网络,但核心是围绕数据的利用展开的。 如果在大规模的去中心化网络中,保护数据的隐私性,必然成为一个非常重要的课题。因此,如果DePIN 注定要发展,那隐私保护这个绝对是绕不开的,因此,要关注 DePIN 和 隐私结合的方向。

- DePIN x Gaming,

DePIN 与游戏的结合可以从几方面来理解,

- 大规模的去中心化硬件网络是可能在某种程度上为游戏带来更好的体验的

- 现实可穿戴设备 + 游戏 + 元宇宙 的概念有可能再次火热

- 通过DePIN 硬件设施,可能改变游戏本身的激励机制和游戏体验方式

参考资料

- https://www.panewslab.com/zh_hk/articledetails/8vy12wz3Ft.html

- https://mp.weixin.qq.com/s/DE28WI5hE7OE5s2D-TFLxw

- https://foresightnews.pro/article/detail/53218

- https://depin.ninja/leader-board

- https://depinhub.io/rankings/investors

关于HTX Ventures

这篇文章撰写于HTX Ventures 旗下的研究院团队。HTX Ventures是火币HTX的全球投资部门,整合投资、孵化和研究以识别全球最优秀和最有前景的团队。作为区块链十年行业的先驱,HTX Ventures推动行业内的尖端科技和新兴商业模式发展,为合作项目提供全方位的支持,包括融资、资源和战略咨询,以建立长期区块链生态。目前,HTX Ventures已支持跨越多个区块链赛道的200多个项目,其中部分优质项目已上线火币HTX交易。同时,HTX Ventures 是最活跃的基金中基金(FOF)投资者之一,携手Bankless、IVC、Shima、Animoca等全球顶尖区块链基金共同建设区块链生态。

【英文研报】HTX Research:DePIN: Current State and Prospects

Introduction: DePIN - Current State and Prospects

Singapore / April 30, 2024 – Decentralized Physical Infrastructure Networks (DePIN) are reshaping the blockchain landscape with their innovative use of existing infrastructure and data-centric business models. Moving beyond traditional IoT frameworks, DePIN stands out for its decentralized efficiency and cost-effectiveness.

This report explores the burgeoning DePIN sector, particularly within the Solana network, noted for its robust infrastructure and innovative applications. DePIN projects prioritize tangible profitability over speculative financials and are pivotal in integrating technologies like privacy enhancements, zero-knowledge proofs, and artificial intelligence. The strategic composability with other ecosystems positions DePIN to transform economic systems through data integrity and scalable solutions.

As the leading platform for DePIN, Solana exemplifies the integration of high-performance blockchain technology with physical networks, promising significant economic returns and pioneering new ways to merge technology with practical applications.

HTX Ventures, the global investment arm of HTX, leverages an integrated approach that combines investment, incubation, and research to identify the most exceptional and promising teams around the world. To date, HTX Ventures has supported over 200 projects spanning multiple blockchain tracks, with some high-quality projects already listed on HTX for trading.

Key Takeaways

· While DePIN projects are decentralized physical infrastructure networks, their core business models focus on effectively utilizing data, whether for storage, transmission, sharing, or use.

· There is no need to compare DePINs to traditional IOT projects or categorize them as Web2 or Web3. What matters most is their ability to utilize data efficiently and distribute economic resources effectively.

· DePIN's development will combine blockchain technology to enhance data credibility and establish extensive protocols along with the Internet of Things, creating an infinite network connecting people to people, people to machines, and machines to machines.

· When assessing DePIN projects, it's crucial to disregard speculative or financial aspects, which are more applicable to sectors like DeFi, meme, and BRC20. Instead, the focus should be on a project's profit potential.

· In the near term, attention should be paid to the composability of DePIN with other ecosystems, such as DePIN x Privacy, DePIN x Gaming, DePIN x ZK, and DePIN x AI. In the long term, DePIN's future involves gig economy, sharing economy, and data credibility.

· The Solana network has emerged as the preferred blockchain for deploying DePIN projects. Solana DePIN projects boast an FDV exceeding $10 billion and a market capitalization of over $4 billion.

· Advantages of Solana for DePIN include:

o Superior performance and technological advancements

o Robust token standards and a thriving ecosystem

o Low cost

o Concentrated liquidity, composable ecosystem, and unified community

o An active developer community driving innovative projects and new concepts

What Is DePIN?

DePIN, short for Decentralized Physical Infrastructure Networks, was first introduced in early 2023 in Messari's research report titled "The DePIN Sector Map." It was defined as leveraging cryptographic economic protocols for the deployment of real-world physical infrastructure and hardware networks. Essentially, DePIN employs a blockchain-driven, token-incentivized approach to encourage collective efforts in building physical infrastructure networks.

While the term "DePIN" is new, projects deploying real-world physical infrastructure and hardware networks via cryptographic economic protocols have been in existence for some time. Notable examples include Helium, a decentralized network created in 2013, and Storj, a decentralized storage solution launched in 2014. These projects explored decentralized ways to build physical infrastructure networks in fields such as communications and storage. Subsequently, sectors like the internet, AI, energy, and data collection followed suit. Despite their differences, these projects share a common underlying mechanism, contributing to the flourishing landscape of DePIN today.

Current State of DePIN

Overview

As of 2023, data from Messari and DePIN.Ninjia revealed that the DePIN ecosystem comprised 650 projects with a total market capitalization of $35 billion. These projects span various sectors, with 250 in computing, 200 in AI, 100 in wireless, 50 in sensors, 50 in energy, and 25 in services. The DePIN landscape's potential market size is estimated at approximately $2.2 trillion, projected to reach $3.5 trillion by 2028, according to Messari.

According to CoinMarketCap (CMC) data, 60 DePIN projects have issued tokens, collectively amounting to a market cap of $1.33 billion. Among the top 100 projects by market cap are FIL, RNDR, HNT, THETA, BTT, AKT, and AR. Other notable examples include IOTX and ANKR, along with AI-related projects like TAO. The majority of the top 10 projects focus on AI, storage, and computing. However, DePIN currently occupies a small share of the crypto market, falling behind sectors like Meme, DeFi, and NFTs. Compared to the traditional IoT sector, DePIN has only 21 projects with a market cap exceeding $100 million and only 4 surpassing $1 billion.

Based on these figures, the potential profitability of the DePIN sector is expected to be 243 times in the near-to-medium term and over 400 times in the mid-to-long term.

Breakdown of DePINs

Similar to IoTeX, DePINs can be categorized into software and hardware projects.

Hardware encompasses sensors and wireless networks, while software includes computing, storage, network distribution, and AI.

Although DePIN projects are decentralized physical infrastructure networks, their core business models focus on extracting value from data.

· Sensors are responsible for data collection.

· Wireless networks and network distribution are responsible for data transmission.

· Computing is responsible for data processing.

· Storage is responsible for data storage.

· AI is responsible for data application.

While hardware serves as the foundation, the evolution of DePIN projects lies in their ability to effectively utilize data. This echoes the growth model seen in traditional internet economies.

Therefore, evaluating a DePIN project's potential requires a data-focused approach. Projects that utilize and control data well are more likely to succeed.

It's essential to remove the speculative elements of crypto and focus on tangible value.

DePIN Investors

As mentioned earlier, investment institutions and entrepreneurs have shown significant interest in the DePIN sector. The limited number of new DePINs in early 2023 was primarily due to unfavorable market conditions and the sector's nascent stage. By the end of 2023, improving market conditions and accumulated experience led to the emergence of tangible prototypes, prompting their introduction to the market. These developments garnered attention, establishing DePINs as a noteworthy presence in a landscape hungry for technological innovation.

Venture capital firms like Multicoin, Borderless, A16Z, and HTX Ventures have made substantial investments in the DePIN sector, focusing on projects with robust utility and minimal speculative elements. That said, DePINs still represent a small portion of their portfolios.

Institution

Number of Projects

Projects

1

Borderless

13

Hivemapper, Xnet, Render, Helium, Arweave, Filecoin, Dimo, Dabba, Planetwatch, CUDO, WAYRU, CLIMATE TRADE, Daylight

2

Multicoin

12

Fluence, BrainTrust, Dabba, Arweave, dClimate, Blackbird, Worldcoin, Livepeer, Render, Helium, io.net, Hivemapper

3

Coinfund

9

Numeraire, Upshot, Giza, Worldcoin, dClimate, GIANT, Livepeer, Dimo, Gensyn

4

A16Z

6

Arweave, Blackbird, worldcoin, Filecoin, Helium, Braintrust

5

DCG

6

Bittensor, Livepeer, Fleek, Filecoin, Worldcoin, Meson Network

6

Polychain Capital

5

Filecoin, Fleek, Really, Upshot, Bittensor

7

Varient

4

Blackbird, Braintrust, Dimo, Worldcoin

8

PlaceHolder

5

Foam, Filecoin, WeatherXM, Numeraire, Arweave

9

Lattice

4

Arweave, Dimo, Filecoin, Nosh Delivery

10

HTX Ventures

4

CESS, EverPay, Pyth, Spacemesh

The following image shows the capital raised by top DePIN projects.

Top DePINs by Capital Raised

Solana DePIN Projects

Solana: The Preferred Choice for DePIN Project Deployment

· Solana DePIN projects boast a Fully Diluted Valuation (FDV) exceeding $10 billion and a market capitalization of over $4 billion.

According to CMC data, the top 500 Solana DePIN projects by market capitalization feature Render Network (RNDR), Helium Network (HNT), and Helium Mobile (MOBILE). Other notable DePINs include Helium IOT (IOT) and Hivemapper (HONEY). Recent trending projects include MOBILE and IOT, as well as getgrass, a bandwidth network market project set to issue tokens.

· DePIN and Solana: A Synergistic Partnership

Solana's recovery is attributed in part to the irreplaceability of Mass Adaption, especially DePIN and Web2 applications. Solana successfully met the needs of STEPN, a project that made Web3 stand out.

Solana's cNFTs provide DePIN/PoPW nodes with more cost-effective authorization certificates, which is a common practice.

The migration of RNDR and Helium to Solana has empowered these projects with enhanced capabilities. For instance, Render's transition enabled new features such as real-time streaming, dynamic NFTs, and state compression. This has significantly improved the network's performance and scalability while unlocking its range of use cases.

Unlike high-value DeFi applications, DePIN projects are closely aligned with traditional edge computing and IoT concepts. They prioritize stability and affordability, while Solana excels in synchronization. Helium, with over 300,000 IoT devices and 3,000-some 5G devices, underscores the huge demand for hardware coordination, which can only be satisfied by Solana.

· DePIN Brings High Value to Solana

Projects like Helium have remarkably increased the number of active wallets within the Solana ecosystem. Helium alone reports over 60,000 active wallets monthly, engaged in activities like reward collection, staking, delegation, or token burning. Additionally, over 30,000 wallets are using other SPL programs, highlighting Helium's impact on the Solana ecosystem.

From the perspectives of regulators and policymakers, DePIN showcases Solana's practical application, enhancing its legitimacy and brand recognition.

Solana's Advantages

· Superior Performance and Technological Advancements

Solana boasts remarkable throughput capability, handling over 65,000 transactions per second (TPS) at peak times and between 2,500 to 3,000 TPS during regular periods. Notable performance features include rapid transaction confirmations, scalability, and block size. After the Firedancer upgrade, theoretical TPS could surpass 1 million, with routine TPS potentially exceeding 100,000. This is a primary reason why both Visa and DePIN have selected Solana.

· Robust Token Standards and a Thriving Ecosystem

Solana is a dynamic ecosystem with well-tested DEXs and established standards such as compressed NFTs (cNFTs), programmable NFTs (pNFTs), and Token Extensions. These provide fundamental components for DePIN projects to develop and launch their on-chain products.

· Low Cost

Even after the Cancun upgrade, Solana remains a low gas fee L1 solution. Some leading L2s, including ZK Rollup-based ZkSync and Starknet, as well as Optimistic Rollup-based Optimism and Base, have switched their DA layers to Ethereum mainnet Blob. This has reduced gas fees significantly, but not to the lowest level, as they didn't switch to Celestia.

· Concentrated Liquidity, Composable Ecosystem, and Unified Community

Significant ideological differences between Ethereum and other L2s have led to liquidity competition. This has been particularly pronounced in the current bull market, where minimal differentiation in technologies and ecosystems has resulted in limited wealth opportunities. General L2s pose no threat to competitive chains like Solana.

Driven by the recent momentum of meme coins, Solana's DeFi ecosystem has experienced rapid growth, with TVL reaching $3.3 billion. This suggests the launch of more attractive yield products and speculative products on Solana. Coupled with RWA, AI, and DePIN projects, DeFi products are poised for greater composability.

· An Active Developer Community Driving Innovative Projects and New Concepts

Solana has nurtured an active developer community through hackathons and various incentives, driving the expansion of its ecosystem. Prominent projects like Magic Eden, Stepn, and jito have emerged. Solana maintains its developer ecosystem and community activities even during bear markets. Through consistent incentive measures and hackathons, Solana has improved its infrastructure and stimulated greater development of innovative applications, further fueling its ecosystem's growth.

· Wealth Creation as the Best Marketing Tool

Saga's massive airdrops lead the way for crypto phone strategies, fostering the unity within Solana's communities. Projects like Solend, Helius, Chads, and Solcial have announced airdrops, benefits, and giveaways for Saga 2 owners. In the recent bull market, meme coin $BOME achieved the feat of being listed on Binance within just three days.

Ecosystem Developments

Below is a summary of DePIN projects on Solana

DePIN Category

Project Name

Wireless networks

Helium, Wifi Dabba

Storage networks

Shdw Drive, Aleph

Sensors

Hivemapper, Onocoy, WiHi

AI

Render, io.net, Nosana, Grass, Synesis One, UpRock, Shaga, DAIN

Services

Teleport, Proto

Infrastructure

Sphere, Solsplits, and Token Standards (compressed NFTs, SPL token)

Summary of the Solana DePIN Ecosystem:

Leading Projects: RNDR and Helium

- RNDR is a decentralized rendering platform.

- Helium Network is a wireless network project. Since its inception in 2014, Helium has raised over $350 million from renowned investors such as a16z, Deutsche Telekom, Google, and Tiger Global. It migrated to the Solana blockchain in April 2024. Its current ranking on CMC is 64.

Second-tier Projects: Helium series (MOBILE and IOT), io.net, and Nosana

- MOBILE and IOT are projects within the Helium ecosystem.

· IOT: The protocol token for the Helium IoT network, mined by LoRaWAN Hotspots through data transmission revenue and coverage proof.

· MOBILE: The protocol token for the Helium 5G network, awarded to those who provide 5G wireless coverage and Helium network validation. MOBILE is currently ranked 166th on CMC.

- io.net is a "GPU Aggregator" that integrates GPU networks from data centers, crypto miners, and projects like Render, utilizing computing power for machine learning applications. Yet to issue tokens, it has 426,000 followers on Twitter. Its Serie A financing totaled $30 million, led by Hack VC, with participation from Multicoin Capital, 6th Man Ventures, M13, Delphi Digital, Solana Labs, and Aptos Labs. Its GUP miners have exceeded 50,000.

- Nosana is a consumer marketplace connecting user-provided GPU networks and aiming to develop AI products.

Potential Projects: ALEPH, HONEY, and Shadow

- ALEPH is a storage solution and interchain database.

- Hivemapper (HONEY), launched in November 2022, is a decentralized global mapping network, rewarding contributors who collect 4K street images using dash cams through the Drive-to-Earn model. In April 2022, the project completed $18 million in financing, led by Multicoin Capital, with participation from industry professionals such as Solana's founder, former Apple Maps executives, and Helium's CEO. Hivemapper is currently ranked 513th on CMC.

- Shadow, a rival to Filecoin, employs Shdw Drive to reduce the cost of corporate data center storage by utilizing efficient traditional and action computing – a technology called DAGGER.

Prospects of DePINs

· As DePIN projects demand infrastructure with high throughput, they are likely to be established on high-performance L1 networks, or even on L2 or L3 solutions.

· DePIN projects may explore various possibilities, including clean energy infrastructure and virtual power plants, exemplified by projects like Daylight and Etheos.

· The transition of DePIN projects to larger platforms, as observed with Helium and Render, enables smaller projects to harness their capabilities for further development.

· Dedicated DePIN chains have emerged, such as Peaq and IoTeX, two EVM/substrate chains specifically designed for DePINs. Additionally, some blue-chip DePIN projects, like Dimo, are using Polygon CDK to build their chains, indicating the demand for application chains.

· The composability of DePIN with other ecosystems is particularly evident on Solana, exemplified by the wealth opportunities resulting from Bonk's airdrops to Saga holders. In the future, we can anticipate further integration between DePIN and DeFi for enhanced returns and speculative activities, as well as the fusion of DePIN with RWA, providing financing solutions for projects or data for the real world.

Let's look at some examples.

· DePIN x ZK

As technology continues to advance, solutions like ZK TLS can prove the authenticity of Web2 or Web3 data, bridging the gap between the two. Combining DePIN with ZK technology will give rise to a flurry of Web3 projects capable of "vampire attacking" their Web2 counterparts, a development worth noting.

Take Space and Time as an example.

Space and Time is a verifiable compute layer that extends zero-knowledge proofs on decentralized data warehouses, providing trustless data processing for smart contracts, LLM, and enterprises. It connects indexed blockchain data with off-chain datasets and adopts Proof of SQL to prevent computations from being tampered and to validate the integrity of query results.

Proof of SQL, a new ZK-proof develped by Space and Time, allows the data warehouse to generate a SNARK cryptographic proof of SQL query execution, proving that query computation was done accurately and that both the query and the data are verifiably tamperpoof.

Through the project, developers can connect indexed on-chain and off-chain data, and perform low-latency cached queries and large-scale analytical tasks using SQL transformations. Additionally, they can customize data into business-specific patterns, deploy queries to APIs, and build dashboards. Meanwhile, zero-knowledge technology ensures that tamperproof query results are sent to smart contracts in a trustless manner or directly published on-chain.

Currently, Space and Time has indexed Ethereum, Polygon, Sui, Sei, and Avalanche. It is supporting more chains while integrating with Chainlink.

· DePIN x AI

The development of decentralized physical infrastructure networks could revolutionize data utilization, including decentralized machine learning, exemplified by projects like Bittensor.

Bittensor is an open-source protocol that powers a decentralized, blockchain-based machine-learning network. Machine learning models engage in collaboration training in TAO and receive rewards based on the value of information they contribute. TAO also facilitates external access, empowering users to extract information from the network and customize network activities to suit their requirements.

· DePIN x Privacy

As mentioned earlier, while DePINs are decentralized physical networks, their business models focus on data utilization. Protecting data privacy is paramount for large decentralized networks. Consequently, integrating privacy protection measures is imperative for the growth of DePIN. Therefore, it's crucial to keep an eye on the sector's integration with privacy-enhancing technologies.

· DePIN x Gaming

The integration of DePIN and gaming can be analyzed from multiple angles:

1. Large decentralized hardware networks may enhance gaming experiences to some extent.

2. The combined concept of real-world wearable devices, gaming, and metaverse could become popular again.

3. DePIN hardware infrastructure may reshape incentive mechanism and gaming experiences.

References

1. https://www.panewslab.com/zh_hk/articledetails/8vy12wz3Ft.html

2. https://mp.weixin.qq.com/s/DE28WI5hE7OE5s2D-TFLxw

3. https://foresightnews.pro/article/detail/53218

4. https://DePIN.ninja/leader-board

5. https://DePINhub.io/rankings/investors

About Us

This article is a product of diligent work by the HTX Research Team that is currently under HTX Ventures. HTX Ventures, the global investment division of HTX, integrates investment, incubation, and research to identify the best and brightest teams worldwide.

With a decade-long history as an industry pioneer, HTX Ventures excels at identifying cutting-edge technologies and emerging business models within the sector. To foster growth within the blockchain ecosystem, we provide comprehensive support to projects, including financing, resources, and strategic advice.

HTX Ventures presently backs over 200 projects spanning multiple blockchain sectors, with select high-quality initiatives already trading on the HTX exchange. Furthermore, as one of the most vigorous Fund of Funds (FOF) investors, HTX Ventures collaboratively forges the blockchain ecosystem alongside premier global blockchain funds, including IVC, Shima, and Animoca.

Contact Details

Michael Wang

Company Website

https://www.htx.com/en-us/ventures

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by HTX Ventures. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About HTX Ventures” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.